Stronger Financial Position

The University improved its financial position in over five years through 2019.

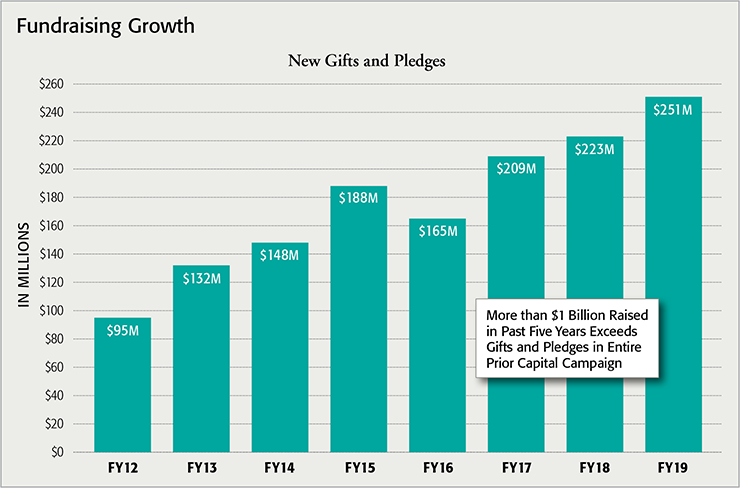

Fundraising: The Rutgers University Foundation completed its first billion-dollar capital campaign in 2014 and achieved several record-breaking years in fundraising, including a new high of $251 million in fiscal 2019.

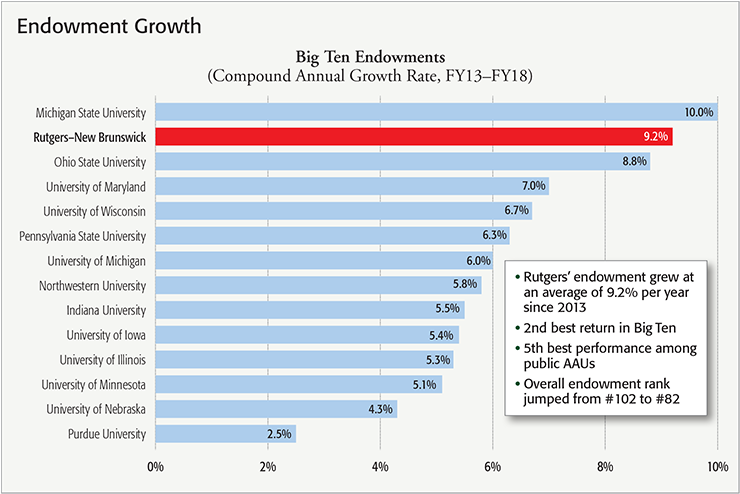

Endowment: Rutgers hired a director of investments and, with governing board consent, revised its strategic investment allocation and engaged a new investment consultant. The endowment grew at an average of 9.2 percent per year from 2013 to 2019, the second-best return in the Big Ten and fifth among public AAU institutions. Rutgers had the 82nd largest endowment among U.S. universities, up from 102nd, through 2019.

Bond Ratings: Rutgers’ sound fiscal health led to strong bond ratings.

- 2017: Moody’s Investors Service reaffirmed its Aa3 rating and upgraded from negative to stable.

- 2018: Standard & Poor’s (S&P) affirmed its A+ long-term rating and determination of a stable outlook for all Rutgers general obligation bonds.

- 2019: Moody's and S&P affirmed their ratings: Aa3/stable (Moody's) and A+/stable (S&P).

S&P credited Rutgers’ “extremely strong enterprise profile” to the breadth and depth of our academics and improvements to our management and governance, including a focus on enterprise risk management.